Business Stories

Uber’s hidden gold mine: How does the food delivery service become a billion dollar business?

According to foreign media reports, Uber has become a world-renowned taxi service company, but people do not know that it has a hidden gold mine. This is its food delivery application Uber Eats. Now, Uber Eats has become a billion-dollar business.

As early as 2008, the taxi service company Uber promoted its initial car service application plan to investors, but it was only later that they heard that the meal delivery service might become another source of profit for the company.

Ten years later, the meal delivery service is no longer an afterthought.

Uber will ship about $10 billion worth of food worldwide this year, up from an estimated $6 billion last year. Uber charges 30% of the commission and delivery costs, and then pays the rider’s salary, which indicates that Uber Eats can generate at least $1 billion in revenue this year, estimated to account for 7% to 10% of Uber’s total revenue.

Uber CEO Dara Khosrowshahi

This means that Uber Eats is already one of the world’s largest takeaway services, ranking second in the US after competitor Grubhub (estimated at $1 billion in 2018) and ahead of competitions such as Caviar, PostMates and DoorDash. opponent.

Uber can of course use this additional source of income. The San Francisco-based loss-making company received a valuation of about $76 billion in its last financing in August 2018. Bankers hope that the IPO scheduled for later this year will raise this figure to $120 billion.

But the problem is that Uber’s core car business can’t be worth that much. Its growth rate has shown signs of slowing down, and internationally, the car service has been difficult.

In August 2016, Uber sold its business in China to local competitors and sold it to Grab in Southeast Asia.

Uber’s autonomous driving business was once thought to be a solution to the increase in driver costs, but after a self-driving car in Uber crashed a pedestrian in March 2018, the company suspended the test and fired the worker.

Now, as Uber is ready to tell investors why they should buy their stock instead of competitor Lyft’s stock, Uber Eats seems to be a distinctive highlight of the company.

Cosrossasi, who took over as CEO in August 2017, said: “When I first joined Uber, I thought that Uber is much more connected to the car service. Uber Eats is just a fun amateur job. Since then, Uber Eats has quickly grown into a truly meaningful business.”

Smart investment is still stupid

Despite the growth, Uber Eats has lost a lot, and even Kosrosa does not know when it will be profitable. Uber’s potential investors will have to decide whether the food delivery service is a smart investment in future growth or a stupid thing in a crowded market?

This is a familiar issue for the 40-year-old Jason Droges, the former CEO of Travis Kalanick. Since the establishment of Uber Eats in 2014, Drogers has been responsible for operating the delivery service.

Some of the most critical obstacles he has to overcome are from Uber’s pre-IPO investors. They believe that Uber is repeating the mistakes of Webvan’s online grocery retailer Webvan and online distribution company Kozmo.com.

In the late 1990s, Webvan received more than $700 million in funding through new food distribution services. The online distribution company Kozmo.com spent nearly $300 million trying to provide video games and convenience store delivery services.

Drojes dismissed these comparisons and competition. “The whole world is telling us that this is a crowded space. But we think that this is not the case,” he said.

Making money from distribution services is not easy. Admittedly, Uber Eats has received many restaurant orders and charges a shipping fee, usually between $2 and $8. However, Uber must pay for the rider’s meal and delivery, and also to advertise the service.

On average, Uber charges a lower percentage of the commission in the order than the taxi business. Restaurants are semi-voluntary partners at best, they can’t afford a 30% commission. Moreover, because Uber is not willing to let you share the delivery costs with paying customers, it can use less network efficiency.

Its largest competitor, the publicly traded Grubhub, has proven that you can profit from this business. This success has made it a strong competitor, and it is not the only competitor: in the US, Uber must work with Caviar, a capital delivery service owned by mobile payment company Square, capital-rich startups DoorDash and PostMates, and potential The giant Amazon is competing.

The birth of Uber Eats

In March 2014, Karanic recruited Drogers to lead the so-called Uber Everything. He co-founded a file-sharing startup with Drogers while studying at the University of California, Los Angeles (UCLA) undergraduate. His mission is to find a business that is as big as a taxi service. Drojes tried to distribute everything from diapers and deodorants to daisy and dry cleaning. As a result, nothing worked – except for food.

After some special attempts, such as the ice cream and grill on July 4th, Uber began to seriously try Uber Fresh for the first time. Uber Fresh allows riders to shuttle between city blocks with a refrigerated box filled with soups and sandwiches, and delivers homes to subscribers in minutes.

In August 2014, on the day of the launch in Los Angeles, the Uber Fresh team sold hundreds of food items in an hour and a half, which was a huge leap from eight deodorant orders a day.

This is a correct market, but it is the wrong product. With a click on the app, you can have the driver appear in front of you in 5 minutes. Although this is amazing, Drogers realized that if customers can order any food they want, they will be willing to wait for 30 minutes.

Internally, the team quietly started the Agora project (meaning the market in Greek) and is preparing to launch Uber Eats.

In 2015, they chose to launch Uber Eats in Toronto. The reason for choosing this city is because the competition here is smaller than a city like New York. They then expanded to secondary cities such as Miami, Houston, and Tacoma in Washington.

Several markets (Miami and Atlanta) achieved profitability in 2017, proving that this business is feasible, at least in some places.

But when Uber Eats was sought after, Uber was exposed to sexual harassment, gender discrimination and unethical business practices. Uber’s management team collapsed completely. In the end, Karanic was ousted, and other groups, such as self-driving cars, lost their department heads.

But Drogers and his team of nearly 2,000 people are basically safe and sound. He admits that this is a “difficult year,” but he told his team to keep a low profile and execution.

What excites Uber executives most is that many Eats users don’t even use the car service: Last year, 4 out of every 10 people who used Eats never used the Uber taxi service. This allows the company to reach new users who may later be convinced to try their taxi service.

“In Uber’s affiliated business that has been bet on for years, whether it’s autonomous vehicles, other merchandising services, or different modes of transportation, this is clearly the largest business that corporate executives are most concerned about.”

Competitors Mike Ghaffary, former CEO of Eat24

The speed of expansion surprised everyone

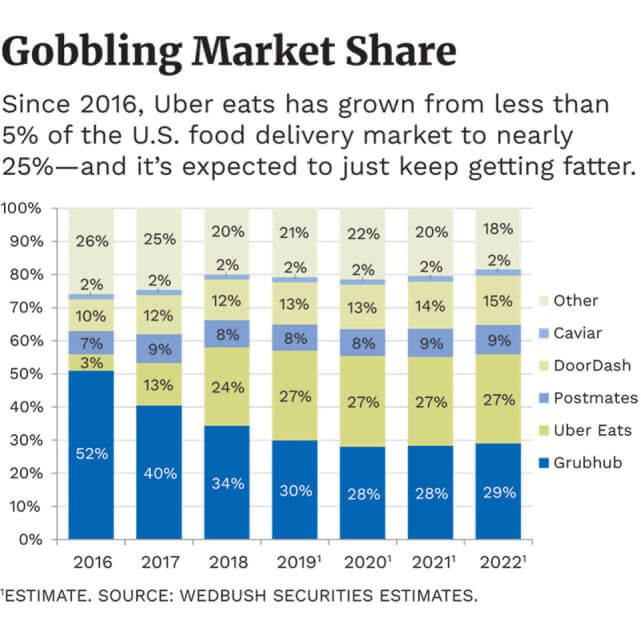

Eats is approaching the US market leader Grubhub. Wyeth Bush Securities analyst Ygal Arounian said that in 2016, Grubhub controlled more than half of the market. In 2018, the company’s market share fell to 34%, while Eats’ market share rose from 3% to 24%.

“The speed of their expansion has surprised everyone,” Arunian said.

However, helping the development of Eats – such as the current generation of young people using mobile phones when they are hungry – has also driven the development of competitors.

In 2018, DoorDash raised about $1 billion in venture capital and pushed its valuation nearly doubled to $4 billion.

In the last six months of 2018, Postmates also raised $400 million and is now valued at $1.9 billion. These two competitors also benefit from their single-minded focus on food distribution.

To cut costs, Uber Eats processes orders in bulk so that drivers can get multiple takeaways at once. However, Kosrosa West also set the principle when recommending Thai-style fried rice noodles to Uber passengers: “We don’t want to let passengers’ ride experience be affected just because it may be good for our taxi business.”

For further development, Uber Eats needs to win more users and restaurants. Drogers is working with McDonald’s and Starbucks, which he believes will help attract customers to open Uber Eats apps instead of competitor apps. Uber also replicated Grubhub’s core business model, allowing some restaurants to ship their own to get a larger share of the order.

Success depends on persuading restaurant owners like Simon Mikhail to believe that Eats is better than the competition. He is the owner of Si-Pie Pizzeria in Chicago.

Mikhail worked with a dozen food delivery service companies, but only Uber Eats found him and proposed the idea of opening a virtual restaurant because the company noticed how many people nearby were looking for fried chicken.

Now, he only sells 160 pounds of chicken per week through the Uber Eats app. “They did take away a little bit of our profits, but it was worth it,” he said.

Do investors also think Uber Eats is worth it? It is now up to DeRogers to convince them.

Share your thoughts on Uber Eats in comments.